News / Notification

Our Banking Services

We have provide lot of banking services for our valuable customer to easy manage financial.

RuPay ATM Service

RuPay ATM Service

We offers you the convenience of ATMs in India, the fast network in the country and continuing to expand fast! This means that you can transact free of cost at the ATMs of Adarniya P. D. Patilsaheb Sahakari Bank ATM Debit Card. Adarniya P.D.PatilsahebSahakari Bank had joined NFS (National Financial Switch) ATM network. Now our customers have access to more than 2,37,472 ATM’s and more than 27,40,671 POS Terminal’s across the nation. Maximum limit of cash withdrawn is Rs.25,000/- per day in ATM. Maximum amount that can be withdrawn per day is Rs.25,000/- in POS. Adarniya P.D.PatilsahebSahakariBank Ltd Karad provides RuPay Debit card which embedded EMV chip which ensure safe & secure transaction. RuPay is an Indian domestic card scheme conceived and launched by the National Payments Corporation of India (NPCI). RuPay cards are accepted at all automated teller machines (ATMs) & at all POS terminals.

Read more

RTGS/NEFT

RTGS/NEFT

Adarniya P. D. Patilsaheb Sahakari Bank has direct membership for RTGS, NEFT with RBI.It's electronic payment system to transfer funds from one to another in Accounts and Banks, The RTGS system is primarily meant for large value transactions. The minimum amount to be remitted through RTGS is 2 lakh. There is no upper ceiling for RTGS transactions. RTGS Timings : Mon to Sat : 10.30 a.m. to 3.00 p.m. 2nd & 4th Saturday Holiday NEFT Timings : Mon to Sat : 10.30 a.m. to 3.00 p.m. 2nd & 4th Saturday Holiday

Read more

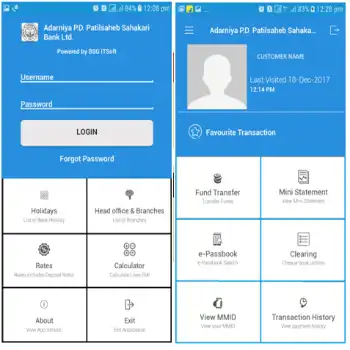

Mobile Banking

Mobile Banking

Adarniya P.D.Patilsaheb Sahakari Bank Mobile Banking discover quick, simple and convenient way to take command of your bank account, on your mobile phone.

Mobile Application Name (Available on Google Play):AdarniyaP.D.PatilsahebMobile Banking application has many features like Balance Inquiry, Mini Statement, and Immediate Payment Service etc.

Features of PDPATIL BANK Mobile Banking:

• Instant & 24X7 funds transfer service through IMPS (using IFSC & Account Number)

• Fund transfer within your own account, Intra bank or Interbank electronic fund transfer

• Maximum limit for fund transfer is up to Rs. 25000/-

• Check balances of your savings and current accounts.

• View Mini Statement (lastTen transactions)

• View transaction history of fund transfer

• Addition / deletion of the Beneficiary

• Quick Transfer to Beneficiaries using QR Code

• View Rate of Interest for Term Deposit & Loan Scheme.

• Search IFSC code for other banks

• Cheque status inquiry

• EMI Calculator

• Holiday list of Bank

• Branch location & IFSC code.

For feedback & suggestions, kindly email us at edp@pdpatilsahebbank.com Contact : 9730919555 / 1800 2334 625 (Toll free)

SMS Banking

SMS Banking

The Bank is providing SMS Banking facilities to all its customers. The customer gets SMS alert of each transaction. Every debit or credit in your account over a limit desired by you is intimated by SMS. Now, with SMS Banking service, you are always in a position to detect unauthorized access to your account. Additionally, SMS banking also helps you to know your balances,mini statements and cheque status instantly by just sending an SMS. Balance Enquiry :- PDPB BQ XXXXXX : Available Balance of your Account (Where XXXXXX are 6 digit of Account Number) e.g. PDPB BQ 005488 to 9220092200 Mini Statement :- PDPB MS XXXXXX : Last 3 Credit/Debit Transactions for Account (Where XXXXXX are 6 digit of Account Number) e.g. PDPB MS 005488 to 9220092200 Cheque Status :- PDPB CS XXXXX : Cheque Status for your Account (Where XXXXX are Cheque Number) e.g. PDPB CS 12452 to 9220092200

Read more

Core Banking

Core Banking

What is Core Banking Solution? Core Banking Solution (CBS) is centralized banking solution , which enables Customers to operate their accounts, and avail banking services from any branch of the Bank . The customer is no more the customer of a Branch. He becomes the Bank’s Customer. Thus CBS is a step towards enhancing customer convenience through Anywhere and Anytime Banking. The customer should utilize cheque for availing ABB services. How shall CBS help Customers? All CBS branches are inter-connected with each other. Therefore, Customers can avail various banking facilities from any branch. The CBS offers customer the following centralized banking services • To make enquiries about the balance; debit or credit entries in the account. • To obtain cash payment out of his account by tendering a cheque. • To deposit a cheque for credit into his account. • To deposit cash into any loan or deposit account. • To deposit cheques / cash into account of some other person who has account in a CBS branch. • To get statement of account. • To transfer funds from his account to some other account – his own or of third party, provided both accounts are in CBS branches. • To transfer funds through RTGS/NEFT from any branch of the bank. (*To safeguard the interest of customers, Bank has placed certain restrictions on the amount of transactions, which are handled through other branches under CBS. The details can be obtained from the branch).

Read more

Lockers

Lockers

Adarniya P. D. Patilsaheb Sahakari Bank provides safe locker facility for the safety of your valuables; our locker facility offers a safe, trustworthy space to store them. There is a nominal annual rent (payable in advance), which depends upon the size of the locker and the centre at which the branch is located. Locker facility is provided by the Bank at its select branches. Adarniya P. D. Patilsaheb Sahakari Bank provides safe locker facility to its customers at very affordable rates. Safe Deposit Locker facilities available at following branches. ( Satara , Umbraj , Masur , Ogalewadi , Mangalwar Peth & Kadegaon ) Terms & Conditions 1. Lockers can be allotted individually as well as jointly. 2. The Locker holder is permitted to add or delete names from the list of persons who can operate the Locker or have access to it locker. 3. Loss of key is to be immediately informed to the base branch & charges are to be paid by Locker holder.

Read more

Semi Demand Draft

Semi Demand Draft

Adarniya P. D. Patilsaheb Sahakari Bank provides Semi Demand Draft service :- • Semi Demand Draft Services • Moderate Commission charges • Facility for all major Cities in India

Read more

ECS / ACH / NACH Service:

ECS / ACH / NACH Service:

ECS / ACH / NACH Service: ECS is an electronic mode of payment / receipt for transactions that are repetitive and periodic in nature. ECS is used by institutions for making bulk payment of amounts towards distribution of dividend, interest, salary, pension, etc., or for bulk collection of amounts towards telephone / electricity / water dues, cess / tax collections, loan installment repayments, periodic investments in mutual funds, insurance premium etc. Essentially, ECS facilitates bulk transfer of monies from one bank account to many bank accounts or vice versa.

Read moreEMI Calculator

Loan, Deposit Rate Calculation